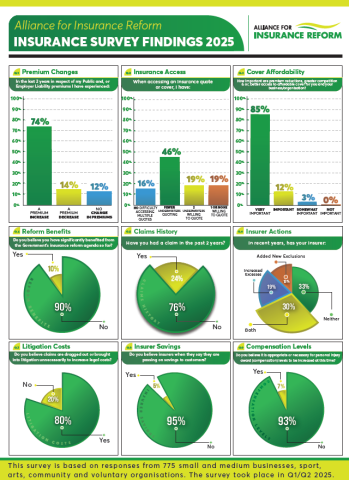

A survey of insurance customers has found that almost three quarters of respondents have seen their premium rise in the last two years, although campaigners say the volume of claims is reducing, awards are coming down and insurance companies are making record profits.

The Alliance for Insurance Reform said that its 2025 Insurance Survey Findings also found a lack of trust in insurers and the legal profession, and a perception that consumers yet to benefit from reforms introduced by the government.

The Alliance said that the “government risks being seen as completely out of touch if it approves an increase in personal injury awards that will see insurance premiums skyrocket” – adding that customers cannot afford another increase.

The campaign group said it had surveyed small and medium businesses, sports, community and voluntary groups in respect of their liability insurance cover in recent months, and received 775 responses, with almost three quarters of respondents seeing premiums rise in the last two years, notwithstanding the recent reforms.

“It should also be noted that these increases are occurring at a time when the volume of claims is reducing, awards are coming down and insurance companies are making record profits,” the Alliance said.

They also noted that one in five respondents have only one underwriter willing to provide insurance cover. “This is a perilous state for them to be in, and we need to see rapid delivery of the government’s commitments to increase competition in the liability insurance market,” the Alliance said.

They found that 90% of respondents said they have not benefited from the government’s action plan on insurance reform. “The last government undertook an extensive programme of reform, and it must be galling for them to see the benefits of these reforms not being shared with policyholders,” the campaign group said.

The survey also found that “four out of five people believed claims were unnecessarily extended by the legal profession to increase their fees”.

“We know from a recent Central Bank report that liability awards are the same on average whether a claimant settles at the Injuries Resolution Board or via litigation. It is therefore astonishing that almost 70% of claims (equating to almost 90% of the overall value of liability claims) continue to be settled in litigation. This is an area that requires much greater examination,” the Alliance said.

In addition, 93% of respondents said they did not believe it was appropriate or necessary for personal injury awards to be increased at this time. “The Minister for Justice is currently poised to recommend a 17% increase in awards to Cabinet in the coming weeks, notwithstanding the fact that awards in Ireland are higher than virtually anywhere else, and he is about to do so in the context of ever rising insurance premiums. It is obvious to everyone what will happen to premiums if this increase goes ahead,” the Alliance added.

The Alliance for Insurance Reform brings together 47 civic and business organisations from across Ireland, representing over 55,000 members, 700,000 employees, 614,000 volunteers and 374,000 students in highlighting the negative impact of persistently high premiums and calling for real reforms they say are necessary to reduce liability and motor insurance premiums to affordable levels and keep them that way.

The Department of Finance has invited interested parties to submit their views on the development of a new Action Plan for Insurance Reform (2025-2029). This consultation aims to gather feedback from stakeholders to shape the next phase of insurance reform.

It says the 2020 Action Plan for Insurance Reform delivered significant progress in stabilising the insurance market, improving competition, and addressing key regulatory challenges. However, some issues remain, and the Government is committed to further reforms that will ensure fairer pricing, enhanced competition, and a more sustainable insurance market for consumers, businesses, and insurers alike.

The insights gained from this consultation will be crucial in shaping the next Action Plan for Insurance Reform, ensuring it is informed by those who interact with the insurance sector directly.

“For years, Ireland’s Duty of Care laws placed excessive liability on businesses, property owners, and voluntary groups, driving up insurance costs and reducing availability. Legislative reforms have now clarified responsibilities, creating a fairer balance between occupiers and visitors,” the Department says. These changes: Encourage personal responsibility while maintaining protections for genuine claims; Reduce legal uncertainty, increasing insurer confidence in covering sectors such as hospitality and SMEs; Stabilise costs, encourage competition, and improve access to insurance, they claim.

The reform of the Personal Injuries Assessment Board (PIAB) and the restructuring and enhancement of PIAB to the Injuries Resolution Board has: Introduced mediation as a service, offering efficient resolution; Expanded the range of cases the Board can assess, limiting costly litigation; Increased consistency and predictability in awards; Reduced legal costs, which has contributed to lower insurance premiums; Enhanced research, reporting and insight on injury trends and costs, it added.

“Despite significant progress, challenges remain. Some sectors still face issues with affordability and availability, and the benefits of reform have not been fully passed on to consumers and businesses. The Programme for Government- Securing Ireland’s Future commits to further action to drive down insurance costs impacting households, motorists and businesses. The next Action Plan for Insurance Reform (2025-2029) will focus on encouraging further competition in the market and working with stakeholders to enhance transparency and affordability across all types of insurance,” the |Department said.

It added that key priority areas include measures to support growth in the insurance market and enhance Ireland’s competitiveness to drive affordability and availability of insurance and strengthen consumer protection.