Sinn Fein’s Pearse Doherty recently pointed out the drastically higher prices Irish consumers pay compared to their European peers.

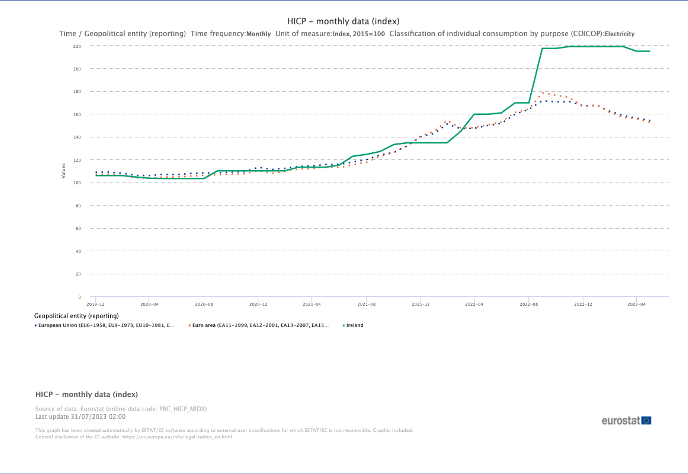

According to Eurostat, Ireland’s electricity tracked European averages until September of 2022 when Irish prices greatly diverged. By October of 2022, Irish prices increased by 28 percent while the European Union (EU) and Euro area (EA) averaged 4 and 9 percent growth respectively.

From October of 2022 to June of 2023, EU and EA electricity prices dropped by 10 and 16 percent while Ireland’s prices remained approximately unchanged. Why did Ireland not follow the European trend for the first half of 2023?

The Ukrainian War created an energy crisis across Europe. Prior to the war, Europe received much of its natural gas from Russia. The war stimulated sanctions that reduced European purchases for Russian natural gas.

In addition, real supply shocks caused by the destructive nature of the conflict reduced supplies further as physical delivery of the natural gas became impossible. This reduction in the supply of natural gas caused a shortage which led to an increase in prices of natural gas.

Natural gas is a main input for many countries’ electricity generation. Thus, a higher natural gas price leads to a higher electricity price. Europe was struggling with these price increases and sought a variety of solutions such as price controls, subsidies, and alternative sourcing. As you can see by the trends before September of 2022, these policies didn’t stop the prices from rising.

Europe eventually achieved reductions in electricity prices because of demand destruction and alternatively sourced natural gas.

The energy crisis led to declines in industrial sectors since they couldn’t afford to stay in operation with the high prices. A significant amount of industrial activity has not returned according to the International Energy Agency (IEA). The lower demand put downward pressure on prices which was compounded by a large increase in new imports of natural gas from other countries.

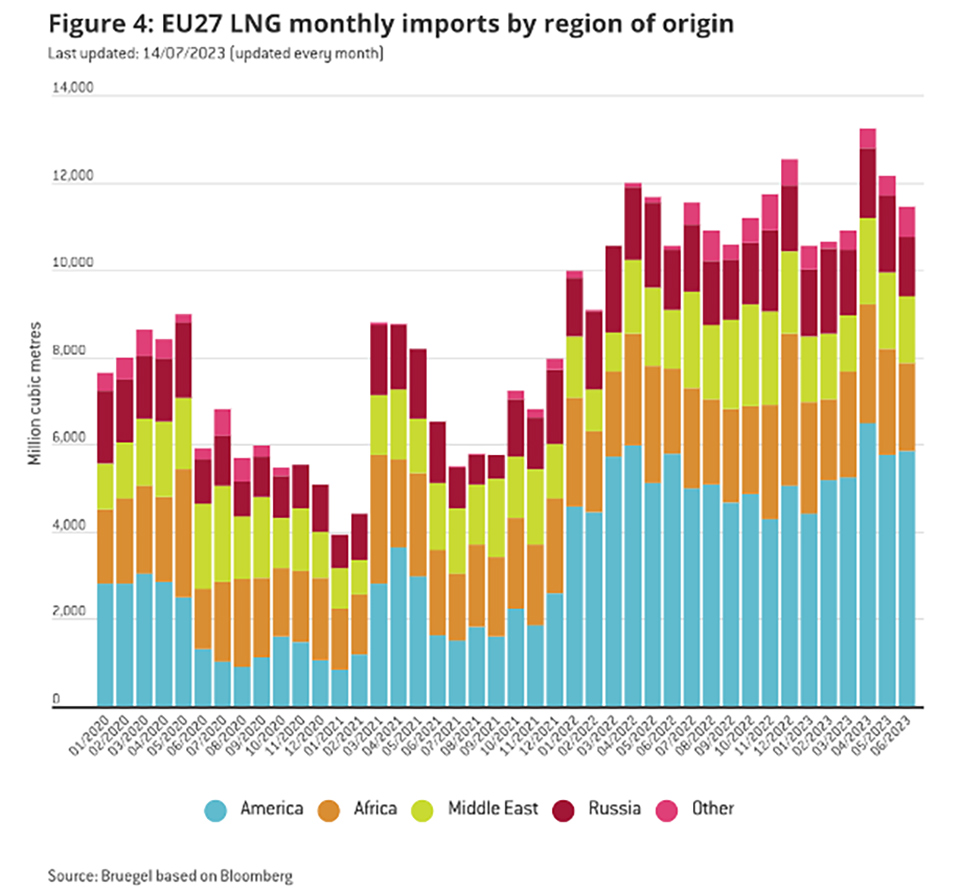

Specifically, American-derived liquified natural gas (LNG) imports increased by about 2.5x followed by significant increases from Algeria and Qatar. The UK also increased exports of natural gas to Europe through its interconnector pipeline.

It took months for the reduction in electricity demand and surge in the quantity of alternately sourced natural gas to translate into lower natural gas prices and thus lower electricity prices. European natural gas prices peaked in August of 2022 and fell thereafter. European electricity prices started falling correspondingly after October of 2022. This shows Europe was able to take advantage of the changes in demand and supply to effectively lower electricity prices.

Ireland for some reason didn’t follow Europe. The most probable reason comes down to contract hedging. According to Dr. Paul Deane, a research fellow at the MAREI Centre for Marine and Renewable Energy and the Environmental Research Institute (ERI) at UCC, “electricity supply companies take long-term perspectives on electricity prices to households, typically over a 12 to 20-month period, rather than a short-term monthly or quarterly view when it comes to retail price setting.”

Barry O’Halloran also reported that Irish electricity suppliers “may have ‘hedged badly’ as a consequence, locking themselves into forward contracts at high prices that may take time to unwind.”

Researchers from Ireland’s Economic and Social Research Institute (ESRI) published their most recent Quarterly Economic Commentary report in June of 2023. They wrote that “the international literature suggests [price reduction] pass-through is in general slow and incomplete, especially in the short run. If Irish firms hedge their prices more relative to firms in other countries, pass-through may be slower than that observed elsewhere… longer hedging positions result in slower pass-through. Thus, there are costs and benefits to higher degrees of hedging: hedging protects consumers from variability in pricing and increases security, but can lock consumers into higher prices for a longer period of time.”

In conclusion, it appears that Irish electricity suppliers hedged in greater degrees than their European peers. Irish electricity suppliers seem to have locked in higher prices for longer terms.

Europe, on average, was quicker at translating price reductions which was most likely the cause of shorter durations on its hedging strategies. Ireland’s unchanged high electricity prices are most likely the result of the stickiness of a relatively high proportion of longer-term hedges and thus will lag the trends of Europe. Eventually, those hedges are replaced by ones better reflecting lower European trends and will induce a reduction in electricity prices paid by Irish consumers.

Dr. Deane estimated that this upcoming August would be the first sign of decreases in price.