Ireland has a housing crisis. It’s causing instability across the country. The current political debates centre around this topic.

Proposed solutions range from tweaking at the margins to radical constitutional changes. But let’s ask one simple question: why does Ireland have a housing crisis?

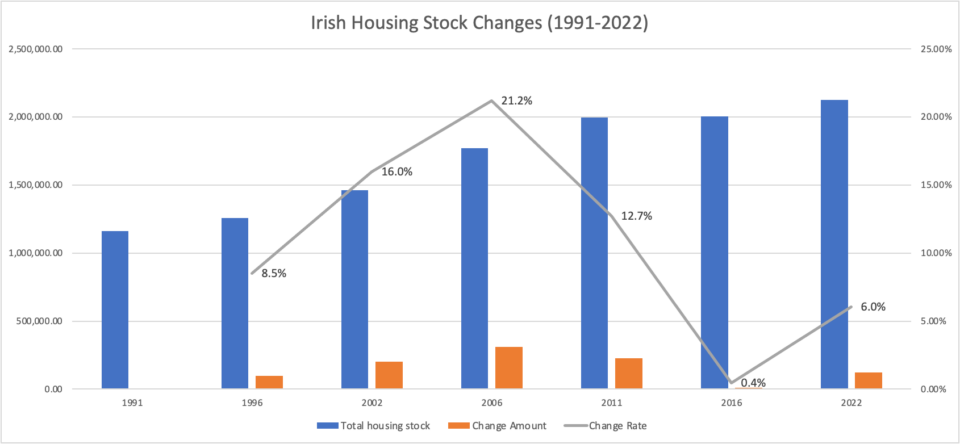

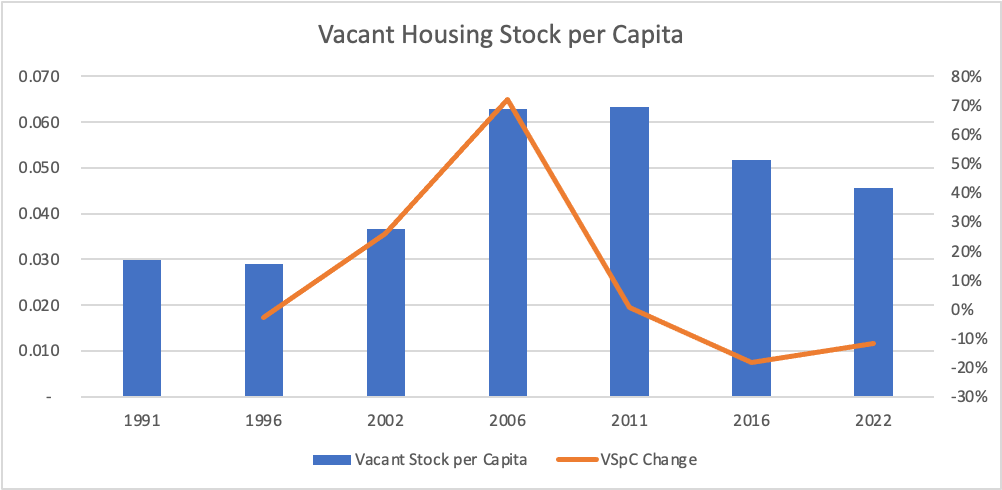

Ireland has a housing crisis because there are not enough homes. Duh! But what else does that suggest? The stock of housing has failed to increase at rates necessary to prevent shortages. After the unquestionably unhealthy 21.2% growth rate in housing in 2006, the growth rate of housing stock has dropped to 12.7% for 2011, 0.4% for 2016, and 6% for 2022.

The growth rate has not recovered to its 1996 level. For perspective, if after 2011 housing grew by just 8% there would be an additional 39,000 homes on the market.

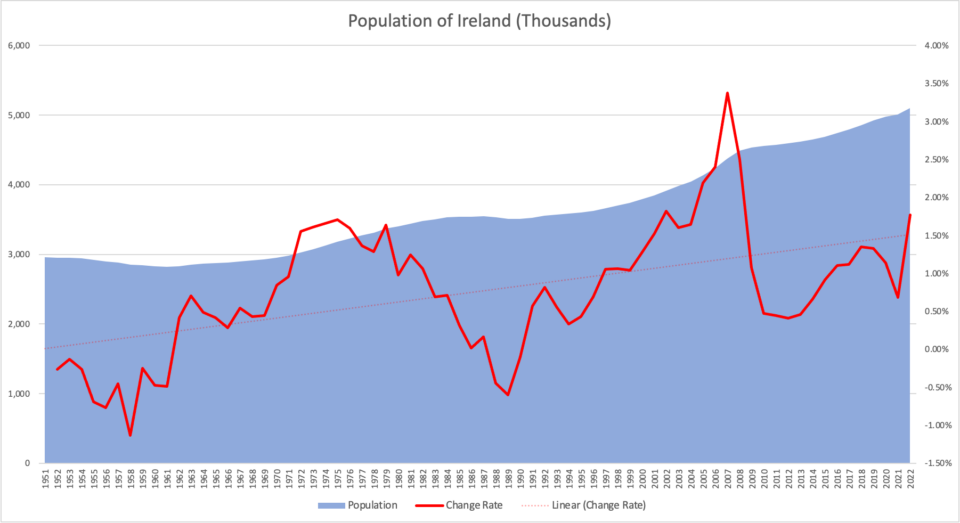

The supply of housing is obviously falling short but now we need to review the demand for housing to truly understand the scope of this problem. Maybe population dropped which meant demand fell and everything is just an illusion.

The opposite is the case. Ireland’s population in 1990 was 3.5M and as of 2022 it stands at 5.1M.

Ireland grew by 46% compared to the European Union’s average population growth of 6%. Even a comparable neighbor like Norway grew at only 28%. Ireland’s population is at its highest level since the 1840s’ Great Famine.

Most of this population growth has come from immigration since the Irish fertility rate has not been above replacement level since the 1980s. Additionally, most of this growth clustered in Dublin.

By 2011, the growth rate of new housing slowed in relation to the growth rate of the population. Since then, population growth has outpaced housing stock growth. The supply is shrinking and the demand is growing.

The demand for housing highlights the lackluster activity to build new supply.

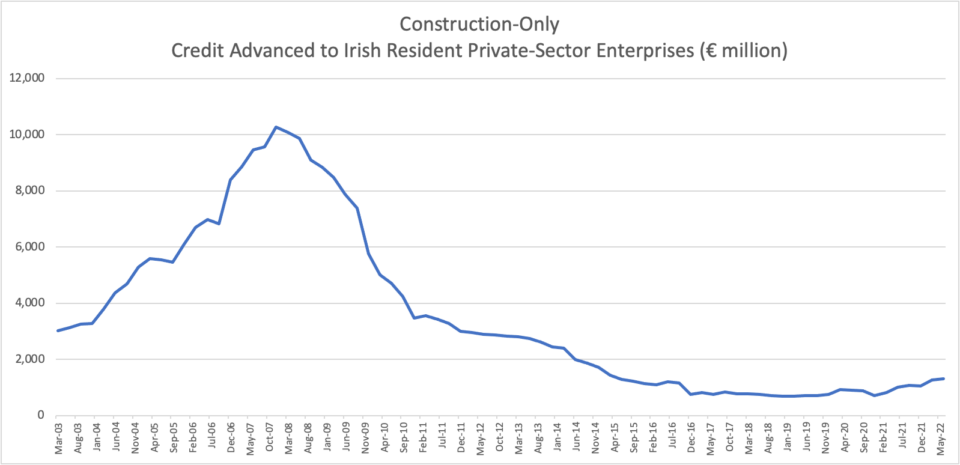

So finally we come to the question: why are housing suppliers not responding appropriately to housing demand? No money. Particularly, money in the form of credit.

Bank credit advanced to Irish construction businesses cratered after the Global Financial Crisis (GFC) of 2008. It is down 87% from its peak and 57% from its more normal level in 2003.

Much has been made of foreign financial “vulture” funds that invest in Irish real estate, but why are those foreign investors able to fill a gap in the first place?

There is a glaring failure of the Irish banking sector to adequately fund the construction of new housing stock.

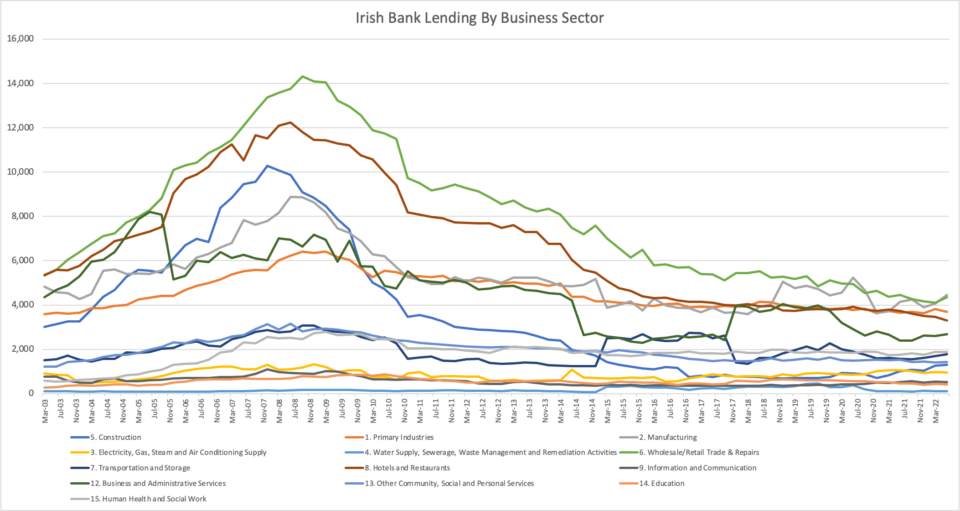

This Irish banking failure doesn’t exclusively exist in the construction sector.

The Irish banking sector has across the board failed to recover from the GFC. Whether it be to households or businesses, it has not reached above 2004 total loan levels. Almost every business sector has the same trend.

The construction of new housing stock is downstream from construction credit and that is downstream from all credit in the economy. The U.S. and Euro Area are both above their 2008 credit levels. Why does the Irish banking sector diverge?

The conclusion of this data is that the Irish housing crisis is caused by a lack of bank finance allocated towards the construction of new homes.

The policy solution should be regulation of the Irish banking sector by the Irish state to increase the quantity of credit supplied especially to new home construction as well as to the general economy too.

Discussion around the Irish banking system’s quantity of credit are pretty muted compared to the mainstream debate. While there is nuance to everything, the big picture is that the Fianna Fáil and Fine Gael seek to solve the housing crisis through more subsidies and/or tax breaks to private and largely foreign investors while Sinn Féin, People Before Profit, and such advocate for direct state construction of homes and/or the controversial state confiscation of what they determine to be “vacant” private homes.

It seems that the easiest solution is to simply tell the Irish banking sector to start acting like every other competent nation’s banking sector and lend adequate quantities of credit to the nation.

In the early 20th century, Irish nationalists complained that Irish banks with Irish deposits were not sufficiently lending to Irish households and businesses. 100 years later this is happening again and it’s a mystery as to why it is allowed to continue unabated.

With all that being said, there are of course other issues that could help mitigate certain problems in housing.

Regulations around landlords, building codes, zoning, local vs. national control, etc. Further regulation could be added to lower mortgage downpayment requirements of 20-35% to something closer to U.S. averages of 6-12% so buyers aren’t priced out of the market.

The vacancy problem for instance is talked about a lot but it’s really not that significant. Vacancies have been trending down in absolute terms and even more so in relative to population terms. The vacant housing stock has decreased from a high of about 15% in 2011 to about 11% today.

Another aspect of the crisis, is that is really a Dublin crisis. Economic activity, the native population, and the migrant population are all disproportionately centered in Dublin. The average property values of Dublin are about 2x of those outside of Dublin. Further work could be done in better regionalizing Ireland.

[…] have resorted to blocking roads to impromptu government immigration centers. The influx has worsened a housing crisis, forcing some to choose between unsuitable accommodations and leaving the country […]

[…] have resorted to blocking roads to impromptu government immigration centers. The influx has worsened a housing crisis, forcing some to choose between unsuitable accommodations and leaving the country […]

[…] have resorted to blocking roads to impromptu government immigration centers. The influx has worsened a housing crisis, forcing some to choose between unsuitable accommodations and leaving the country […]

[…] have resorted to blocking roads to impromptu government immigration centers. The influx has worsened a housing crisis, forcing some to choose between unsuitable accommodations and leaving the country […]