An accommodation centre for asylum applicants opening on Wynnefield Road, Rathmines, seems a fairly standard example of a company which owns hotels deciding that taking a contract from the state is more profitable than trying to fill the place with guests.

The same expectation of ready cash is what attracts others to finance such ventures, of course. That is of public interest because often the funding to property owners to ensure IPAS accommodation centres can go ahead is coming from investment funds and financiers who would see Ireland’s current asylum shambles as an opportunity for significant profits.

As ever, local concerns and requirements have been swept aside – as has the need for planning permission since the government has decided it’s no longer needed in the case of migrant or asylum centres.

In the case of the Rathmines asylum centre, the involvement of Wealth Options Trustees Limited is of interest given how many Irish people lost the money they hoped would be their pension funds to the Dolphin Trust “pyramid scheme” recently.

The Rathmines centre is expected to be able to accommodate 165 persons who have applied for International Protection – asylum applicants, not ‘refugees’ as some in the media and in NGO and political circles carelessly (or deliberately) describe them.

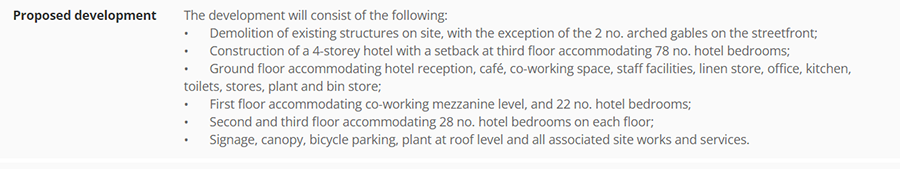

Rathmines Hospitality Limited had been granted permission by Dublin City Council in February 2022 to build a four storey 78 bedroom hotel on the site at 10 Wynnefield Road.

That was approved despite objections from local residents and businesses, among them the owner of the famous Grace’s pub which shares a rear boundary with the site.

One of the bases for the objections considered by An Bord Pleanála at the time was that “The development has characteristics comparable to co-living developments”.

That was argued by the Rathgar Residents Association who wondered if it was a “shared living scheme disguised as a hotel.” They also claimed that “The 78 bedrooms are too small and cramped at 11 m sq. to 13.5 m sq. in size, and it is combined with shared working space.”

As we shall see, giving people sufficient space in which to swing cats or whatever takes their fancy is not a big priority with several of the principals in the Wynnefield project. Such concerns are obviously not of huge consideration if 165 people are going to be occupying the spaces provided.

WHO OWNS THE SITE?

Rathmines Hospitality Limited are listed with the Land Registry as the owners of the site as of February 1, 2023. The two owners of Rathmines Hospitality are Eoin Doyle and Ray Byrne.

The site is charged to Wealth Options Trustees, Elgin Property Finance Security, and WOTL Trustees.

In other words, the funding for the project came from these sources – in much the same way that a bank has a charge on your home when you get a mortgage from them.

WOTL has an interesting history – and was linked to a huge, and widely reported, scandal where Irish investors lost their pension funds in the Dolphin Trust saga.

The Dolphin Trust, later renamed the German Property Group (GPG), collapsed in 2021 owing around €1.2 billion, and leaving losses of €150 million to Irish investors, mostly people who believed that they were investing their pensions in the property market, through WOTL and others.

WOTL were defendants in a case against the estate of the late Paul Dunne who had been managing director of the company which administered Irish investment in the Dolphin Trust.

A case against Dunne’s estate of more than €6.2 million was struck out last November but Counsel indicated that application might be made to re-enter proceedings against Wealth Options and its current directors. The two directors and owners of WOTL Trustees are Éanna McCloskey and Brian Flynn.

Both were directors of Dolphin M.U.T 116 and McCloskey is the sole owner of Tulipfield which was the sole shareholder of Dolphin M.U.T. 116 which along with Dolphin M.U.T 103 was the Irish vehicle for funds which were being invested through the failed Dolphin Trust.

Both entities were liquidated in April 2021, but Tulipfield is still in business and shares the same address in Naas as Wealth Options.

The man at the centre of the Dolphin Trust caper in Germany was Charles Smethurst and he had also been a director of Dolphin M.U.T 116 until October 2020. Smethurst was investigated by the German authorities for fraud for his part in the Dolphin Trust affair and his home in Saxony was raided in March 2021.

Myles Kirby, the liquidator appointed to Dolphin in this country, described the whole thing as a “pyramid scheme.” Smethurst apparently told Irish liquidators that he had merely been a director “on paper” of Dolphin’s Irish operation.

Wealth Options were certainly enthusiastic about Smethurst’s investments in German property and in 2019 assured potential investors that “We have visited the offices of Dolphin several times each year. We have met the chief executive and the chief financial officer at least annually.” Their brochure also assured clients that this was an “asset-backed opportunity” with solid foundations in German land and property.

Myles Kirby who was appointed as the liquidator of one of the Dolphin companies told The Currency in 2021 that he was “not aware of any properties having been completed and sold” as part of the scheme in which WOTL had persuaded Irish investors to become involved.

In his responses to The Currency, McCloskey stressed several times that WOTL and Wealth Options Limited are separate legal entities but they are clearly connected and both are now listed on the charges to the Wynnefield accommodation centre filed with the Land Registry. McCloskey and Flynn are directors and owners of the two companies.

The Pensions Authority initiated proceedings in June 2021 to have Wealth Options Trustees Limited (WOTL) removed as the trustees of seven sample small self-administered pension schemes (SSAPs.) because of WOTL’s role in placing around €41 million of Irish investors funds through Dolphin.

The Pensions Authority suspended the proceedings against WOTL on March 23, 2023, but only on the understanding that WOTL agreed to cease to be the trustees of the specimen SSAPs and would facilitate their transfer to another trustee. They also agreed to cease to be the trustee of any other such funds, and that neither the company nor any of its directors would agree to become a trustee of any other scheme for a period of 5 years.

LUCRATIVE ASYLUM ACCOMMODATION CENTRE

It would seem that WOTL has now found an attractive option for the funds it manages or controls in the lucrative refugee accommodation sector. The same would seem to apply to Elgin Property Finance Security who also have a charge registered against Rathmines Hospitality as part of their interest in the Wynnefield accommodation centre.

Elgin is jointly owned by 288 Western Avenue Limited and Pecuniam Limited. Elgin’s Irish directors are Derek Poppinga and Peter Leonard. Poppinga is the sole owner of 288 Western Avenue and Leonard has a small share in Pecuniam which is 99% owned by Cannon Way.

Poppinga and Leonard were the co-founders of MM Capital, which made the failed bid to create a high-rise 297 unit “shared living” complex on the site of the Phibsborough shopping centre. The plan was rejected last October on the grounds that Housing Minister Darragh O’Brien had announced a ban in 2020 on what then Taoiseach Micheál Martin had described as “glorified tenement living.”

What Irish society and those it places in positions of authority and trust ought to be asking perhaps is why there is not a bit more scrutiny of the people involved in the burgeoning refugee asylum sector.

Wynnefield is just one example of the nexus of interests that have seized upon this opportunity that is now patently at odds with the interests of the local community and business sector.