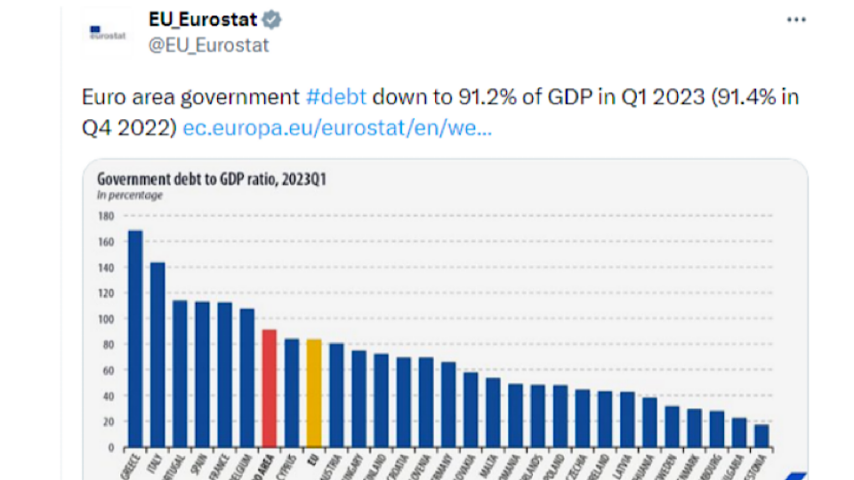

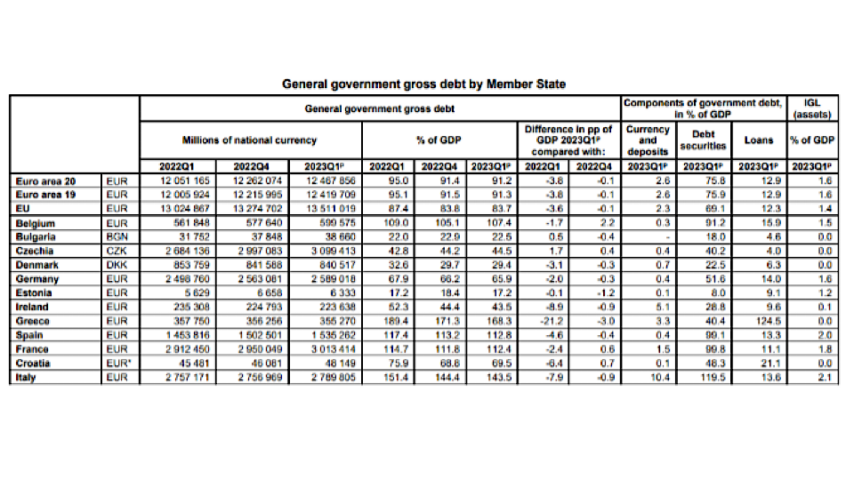

Newly published figures from the European Union appear to bring good news regarding the debt ratio of the Irish state. According to the statistics, the debt : GDP ratio stood at 43.5% for the first quarter of 2023. That is down from 52.3% in the first quarter of 2022 and compares to an EU average of 83.7%.

Unfortunately, when the level of debt which now stands at over €239.2 billion, is measured against different metrics the picture does not look quite so rosy. Firstly, as we looked at previously, Gross Domestic Product is not an accurate measure of the health of the Irish economy, and certainly not of the actual income and wealth of the citizens of the Irish state.

The reason for this is the huge proportion of GDP that is taken out of the Irish economy each year. This is known as Net Factor Income and amounted to $121.6 billion in 2021. The vast bulk of that is accounted for by the repatriated profits of overseas companies based in Ireland. This came to just under a quarter of the total GDP in 2021.

When next factor income is excluded from the figure for GDP, Ireland’s Gross National Income (GNI) or what used to be known as Gross National Product (GNP) came to $383 billion.

When next factor income is excluded from the figure for GDP, Ireland’s Gross National Income (GNI) or what used to be known as Gross National Product (GNP) came to $383 billion.

GDP for 2022 was €500 billion and GNI or GNP was €360 billion, with a net factor income of €140 billion or 28% which indicates an increase the amount of corporate profits being taken out of the state.

Statistics for per capita debt paint a similarly alarming picture of the level of debt measured in terms of the population of the Irish state in comparative terms. While the more recent growth in debt has been attributed to the costs of the Covid Panic, that is rather misleading as not only did most other EU states incur similar costs, but the key factor in the Irish debt continues to be the cost of the bank bailout, not the Covid lockdown.

Statistics for per capita debt paint a similarly alarming picture of the level of debt measured in terms of the population of the Irish state in comparative terms. While the more recent growth in debt has been attributed to the costs of the Covid Panic, that is rather misleading as not only did most other EU states incur similar costs, but the key factor in the Irish debt continues to be the cost of the bank bailout, not the Covid lockdown.

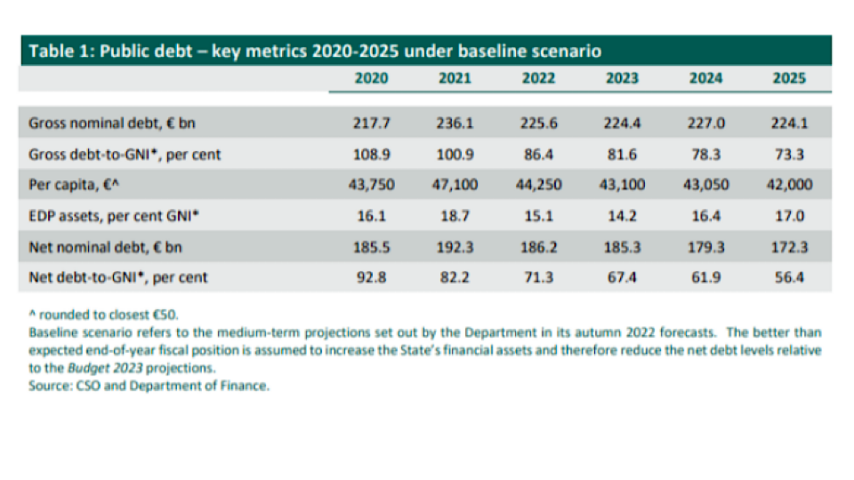

The Department of Finance states, somewhat coyly, that “in part due to the State’s support for the domestic banking sector … the stock of public debt increased by over €160 billion between 2008 – 2012.” To gain a true picture of the impact of the treachery on the part of the Irish financial elite, compounded by the exactions of our “friends in Europe,” just consider that before 2008 the Irish state debt was under €50 billion. It now stands at almost five times that figure.

The Department of Finance publishes an Annual Report on Public Debt at the beginning of each year, and in the report published in February the proportion of debt : to GNI/GNP at the end of 2022 was given as 86%. This was equal to a per capita debt of €44,250 for each person living in the state.

So while the comparative figure for debt : GDP ratio as detailed in the Eurostat table above shows that the Irish state has a ratio lower than most other EU states, and below the average for the EU as a whole, the debt : GNI/GNP paints a rather different picture.

Of the 19 states that are part of the Euro zone, Irish citizens carry a personal debt of more than €44,000 which is much greater than the average for the Eurozone, which is around €36,200. Germans, citizens of the state which above all insisted upon the punitive bailout here in order to save the EU as a whole from the impact of the banking crisis, have an average per capita debt of around €31,000. Even the hapless Greeks who some of our own Europhiles were happy to dump upon for the profligacy of their own elite, carry a personal debt to the EU and other loan sharks of around €34,000.

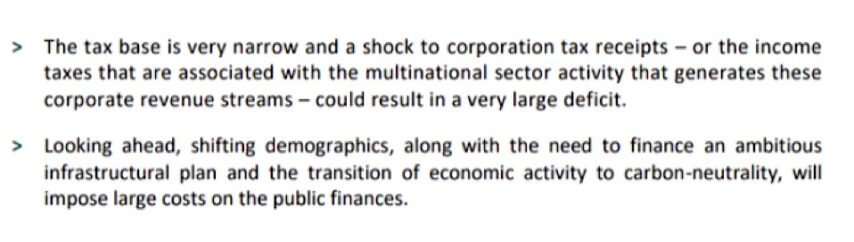

To conclude, while the Government sounds an optimistic note on all of this, the Department of Finance report contains a pretty sombre prognosis. Among the threats posed to the current “healthy” scenario are the over-reliance on international capital and the tax revenue that comes from that sector.

The report also refers to the challenges posed by “shifting demographics.” We all know what they are, as the proportion of persons living in Ireland, both as productive workers and as state dependents, grows steadily. Alongside that, there are the “large costs” associated with the “transition of economic activity to carbon neutrality.”

If there is a theme running through all of this, it is that the Irish state is to a huge extent not shared by many other states in the developed world, almost completely dependent on the vagaries of the global economic and financial system.

What this in effect means is that the entire political establishment and state administration has basically accepted – to coin what the president of General Motors once said about the connection between the fortunes of that company and of the United States – that “What’s good for Microsoft/Google/Apple/the European Central Bank is good for Ireland.”

Well, I for one demur, and perhaps it is time be started to think beyond the next revenue windfall from corporations that do far better from being here than we do from their being here.