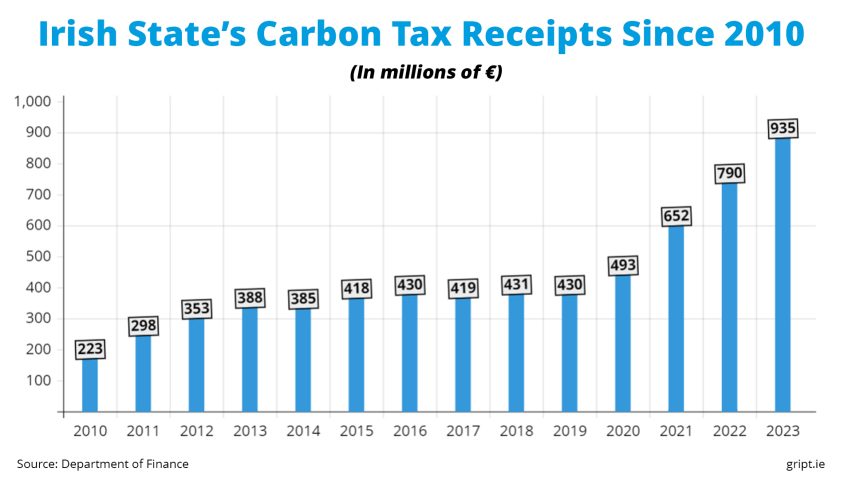

Over €6.6 billion has been paid in carbon taxes since the the tax was introduced in 2010, Gript can reveal.

According to figures acquired from the Department of Finance, a total of €6,650,871,066 was taken in by the State between the years 2010 and 2023, with the annual amount being paid increasing almost every year since the tax’s introduction.

While the State took in €223 million initially in the year 2010, by 2020 this figure had more than doubled to €493.5 million, and then grew even more dramatically, soaring to a provisional figure €935 million in 2023.

A total of €2.8 billion worth of carbon tax has been taken in during the lifetime of the current Fine Gael, Fianna Fáil, and Green Party government coalition, which came to power in 2020.

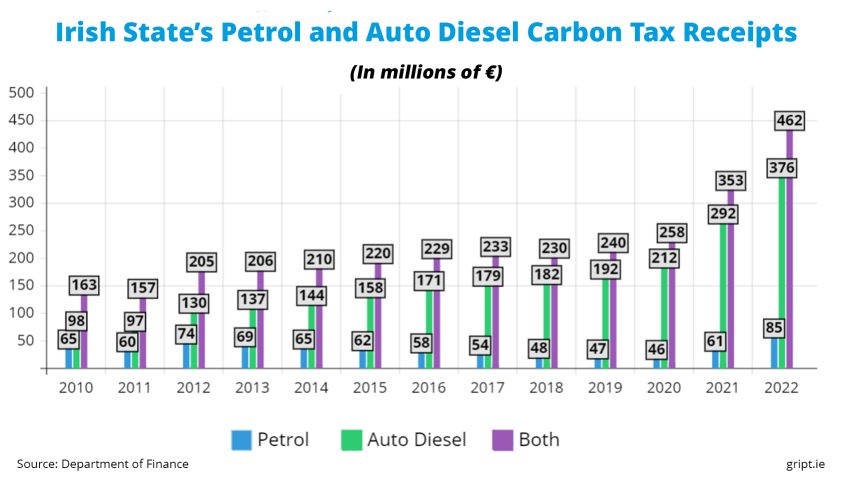

Moreover, between 2010 and 2022, the government took in over €799 million in carbon tax on petrol, and over €2.3 billion on auto diesel, coming to a combined total of €3.1 billion. This also increased significantly under the current government, spiking dramatically in 2022.

By contrast, over the same 12 year period, carbon tax on aviation gasoline only yielded €599 thousand euro for the State, while kerosene – another fuel commonly used in planes – brought in over €694 million.

Regarding home heating, €214.5 million in carbon tax was paid on “solid fuel” – such as coal, wood, or charcoal – between 2013 and 2022, while natural gas – often used in heating, cooking, and electricity generation – was taxed to the tune of €716.8 million.

Other fuel sources taxed included Fuel Oil, Marked Gas Oil, and different forms of Liquid Petroleum Gas (LPG).

The carbon tax is required to be increased every year by law due to the Finance Act 2020, which requires the tax to be raised by €7.50 per tonne of CO2 up until 2029, and €6.50 in 2030, when the rate is set to reach €100 per tonne of CO2.

According to the Parliamentary Budget Office, these funds are then “used to finance green initiatives and other climate related policies such as home retrofits”.

The tax was initially introduced under a Fianna Fáil and Green Party coalition government in 2010, but was maintained by subsequent governments since that time, with then-Transport Minister Shane Ross saying in 2019 that he wanted to force motorists out of their cars using carbon tax to avoid a “climate apocalypse”.

'We want to force private motorists out of their cars' https://t.co/gVpZva6goa pic.twitter.com/dfDHvRNKMq

— Irish Independent (@Independent_ie) June 18, 2019

Last year, Gript asked Finance Minister Michael McGrath if the government would consider suspending carbon tax amid an energy and cost of living crisis.

He replied that they would not, because they were needed to fund “anti-poverty measures” in social protection and to fund retrofitting of homes.

"Does hiking taxes help during a crisis?" Gript presses Finance Minister Michael McGrath on carbon tax hikes, and how he plans to help those in energy poverty.

FULL VIDEO: https://t.co/fLObC2ju6Q pic.twitter.com/K7FYbW511C

— gript (@griptmedia) January 5, 2023

Over €6.6 billion has been defrauded from the Irish public if “There is no climate emergency” as claimed by Clintel.

A global network of over 1900 scientists and professionals from over 60 countries have endorsed this declaration. “Climate science should be less political, while climate policies should be more scientific. Scientists should openly address uncertainties and exaggerations in their predictions of global warming, while politicians should dispassionately count the real costs as well as the imagined benefits of their policy measures.”

Their position is summed up in six points:

Natural as well as anthropogenic factors cause warming

Warming is far slower than predicted

Climate policy relies on inadequate models

CO2 is plant food, the basis of all life on Earth

Global warming has not increased natural disasters

Climate policy must respect scientific and economic realities

Read the full brief World Climate Declaration on their website clintel dot org.

An honest government will encourage the discussion and debate of these points. Our government has made no effort to do so but slanders climate dissenters. We must vote for politicians who are prepared to listen to and consider both sides of the matter.

Thanks for the info on Clintel org

The fresh air tax is a marvellous invention. I remember as a child adults used to complain

when VAT was introduced “they’ll be charging us for fresh air next” . Well here we are in the 21st century and low and behold that is exactly what they are doing.

You couldn’t make it up, except they did.

act like a fool you get treated like a fool is current motto by ff/fg/g view of locals, flood the place with non Irish and Drive Paddy to the pub , drive drink drive drink taxes more taxes and even more taxes ,live on a street here in clonmel nearly all houses on it occupied by non Irish all pubs in town are buzzing,town is swamped with Indians and easteren Europeans,what will Ireland be in 20 years time

in 10 yrs time ( leave alone 20) irish towns will be a replica of what british towns have been for the last 3 decades , a multi racial mixture of people from all over the globe , a large number of whom will live in abject poverty but will not complain or stand up for their rights as they know no better .

we will have ‘ no go areas ‘ where people of different race, religion or colour will not enter during the hours of darkness ,where our daughters,mothers, wives and sister would not go for fear of being raped or assaulted , we will see a rise in ” peadophile grooming gangs’ as happened in towns all over the uk but was seldom reported for fear of ” causing upset to the communities’ involved .

this governments policies on ” hate speech” etc will ensure no one speaks out and those that dare to will be dealt with by the full rigures of the law . this “open border” policy much lauded by the EU a few years ago is already beginning to show cracks , but its too late now , you let them flood in unabatted without documentation or checks on who was coming in , and anyone who spoke against this policy was branded ” racist, xenophobe, nazi , etc etc .

this political clammer for a world wide melting pot of peoples of differing nationalities, colour, religion , culture etc is nothing more than a powder keg that is one day going to explode and those that caused ,aided and abetted that explosion will be the only ones to come out of it alive .

The rotschilds will be delighted in fairness. I have done a bit of forcasting myself and im predicting a sharp decline in existing politicians in the coming months and an increase in actual irish politicians that if they know whats good for them will see a dramatic decline in the marxist taxes. On a side note, there is a story floating around that the rte camera man dropped his phone and his contacts were discovered but I believe this is horse shit because the numbers on it are all indian international codes. 0091. I could be wrong but last time I checked, the citywests number did not start with 0091. Interestingly enough the kakistocracy has signed a two year continuation lease with the citywest hotel which now means you the tax payer could have bought the hotel twice over. https://www.bitchute.com/video/QjU5HeCu7j7k/

Many respected scientists say that there is little, if any, link between CO2 emissions and global temperatures. The carbon tax is a cruel, unfair and regressive tax on essentials like heat and the ability to move around. It is based on the ideology of the Marxist Green Partycwhich got 7% of the popular vote but inflicts its web of misery on us all. The money raised is squandered on cycle lanes which people wont use because of the incessant rain we experience here. Fuel prices will be an election issue. One Green TD, MEP or Councillor is one too many.

All these penal tax monies paid by the Irish taxpayers based on climate change lies…..

This report is shocking, and only one of the many many many green taxes we are paying. I object to paying these taxes as a citizen of Ireland and the EU because around the world others are not doing their bit i.e. India China Brazil US Russia etc. Why should the burden fall on the EU countries; we all share the planet so should all shoulder the burden to fix it. The Irish Govt should have a duty to its people, to not let us be over burdened and restricted unfairly. I want the Govt to stick up for us.

Can we not legally challenge this over burden by our Govt in ECJ as it is interfering with our right to a good family life? We have another 5 years of FF FG Greens coming; the big parties will lose some seats and then be even more reliant on the looney Greens.

As for the climate debate; I’m sceptical of any argument where opposing views are censored. It needs more open debate by people who know what they are talking about.

At the moment the carbon tax is 56 euro per tonne. As laid out in the Finance Act 2020, by the year 2030 the carbon tax is set to be 100 euro per tonne so it due to almost double in the next 6 years. It will be interesting to see how a SF led government will deal with this. My prediction is they will continue with the policies of FF, FG and the Greens and increase the tax at the same rate.

The question that should be getting asked before the next election is who is going to reverse the carbon taxes. They are unfair and unjust based on alot of scientific studies. This green party have taken food from our mouths in order to push there agenda, an agenda that has seen the most stupid inept politicians this country has ever seen made millionaires with golden pensions all while riding the public raw in taxes. There is no reason these taxes can’t be reversed and we should be demanding it. The next irish government is going to be saying no to alot of EU bullshit if they want to stay in power. Its probably going to be fairly unstable from the get go.

And there you have it citizens ,the TRUE reason why our political parties are so keen to enact these ‘ green’ policies !!

as per usual their only answer to ANY problem is to tax it ,put a levy on it , then HIKE IT UP year on year until its no longer affordable for us ‘ plebs’ and only the well connected and well to do can afford these ‘ luxuries’ !!

The problem is THEY know full well that little or nothing will be done about it , the public will moan and gripe for a few days or weeks , but come the next election they will traipse off down to the polling booths and elect THE VERY SELF SAME GOMBEENS AND GOBSHITES as they and their forebares have done for the last 100 + years !!

there is only one way to end this continual political roundabout and that is to VOTE AGAINST THE CURRENT GOVERNMENT PARTIES , do not give them so much as a 10th PREFERENCE VOTE on the ballot paper or they will find some way to weisel their way back into office only to shit on you all once more .

Our leaders refuse to recognize what is happening in Europe because of insane green climate policies. Here is a comment on 16 April 2024 from a German engineer: “The number of Germany’s corporate insolvencies in March reached the highest level on record, new data reveal. It’s the Great Green Energies economic debacle” (my emphasis).