The Alliance for Insurance Reform has hit out at what it calls a “deep disconnect” between falling insurance claims, strong insurer profits, and stubbornly rising premiums.

The campaign group was made its statement after Central Bank data showed double-digit insurer profits, amid falling claims and rising premiums.

The Alliance said that with legal fees now matching awards in the majority of claims, the Government needs to take action to ensure far greater numbers are settled at the Injuries Resolution Board (IRB). Despite the significant programme of government reform, Central Bank report finds that “based on all available metrics premium has trended upwards in recent years.”

Insurers recorded a 10% profit margin (€137m) on liability insurance in 2024, the Central Bank reported – also noting a further 4% rise in average liability premiums – contributing to a 23% increase in premiums since 2020.

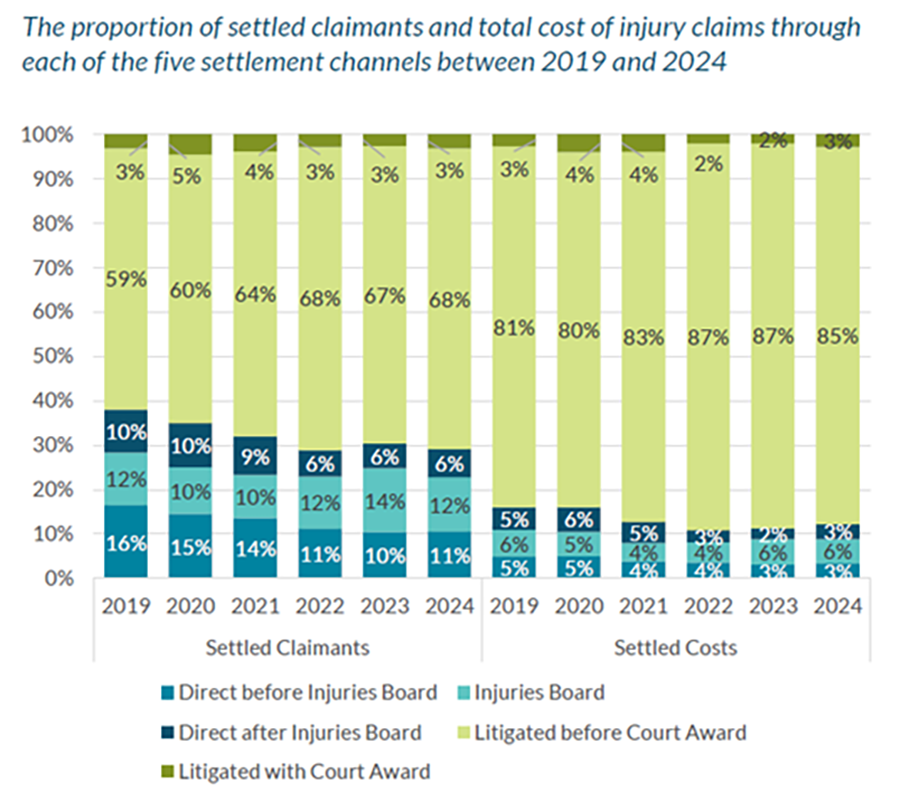

Rising legal costs and the increasing volume of claims settling via litigation has undone much of the savings made by the Personal Injuries Guidelines, the Alliance said.

The Alliance Key said that key findings from the Central Bank’s NCID Liability Insurance Report for 2024 today include:

- Legal fees are now effectively matching compensation awards in the majority of claims settled

- Despite reductions in the volume of claims and size of awards in recent years the average premium for liability policies rose by a further 4% in the year, contributing to a 23% increase in premiums since 2020.

- The liability insurance market was very profitable in 2024, with an operating profit after tax of 10% of total income.

Commenting on today’s report, Tracy Sheridan, owner of Kidspace play centres in Rathfarnham and Rathcoole and Board member of the Alliance, said:

“We now have a system where two people with similar injuries can get similar compensation, but one case costs a few hundred euro through the Injuries Resolution Board while the other costs tens of thousands in legal fees.

It is highly unlikely nearly 70% of claims need to be resolved via litigation and every unnecessary euro spent on litigation is a euro taken from wages, community services and local investment. Government must take decisive action to ensure far greater numbers of appropriate claims are settled at the Injuries Resolution Board. Whilst steps have been taken to increase the volume of cases settling at the Injuries Board in recent years, it is clear much more needs to be done.”

The Alliance also highlights what it calls a “deep disconnect” between falling claims, strong insurer profits and stubbornly rising premiums.

In the context of liability cover the NCID shows that insurers made an after-tax profit of 10% of total income in 2024, while the average premium for liability policyholders rose by a further 4% in the year, contributing to a 23% increase since 2020.

Tracy Sheridan continued:

“The Central Bank’s own figures make the situation crystal clear: claims are down in recent years, insurer profits are up, and premiums keep rising. Businesses, community groups and voluntary organisations are being told that premiums reflect costs, yet insurers appear to be the only ones benefiting from the cost reductions. After all the reforms they introduced in recent years to bring down premiums, the government must be as annoyed with the report’s findings as small business owners.”