The total cost of asylum accommodation and related costs between the start of 2016 and the end of June 2024 is now more than €5,000,000,000. That is Five Billion. The costs are divided between those covering persons claiming International Protection and Ukrainians who have been granted Temporary Protection since the Russian invasion of February 2022.

(From reply to a PQ from Carol Nolan TD)

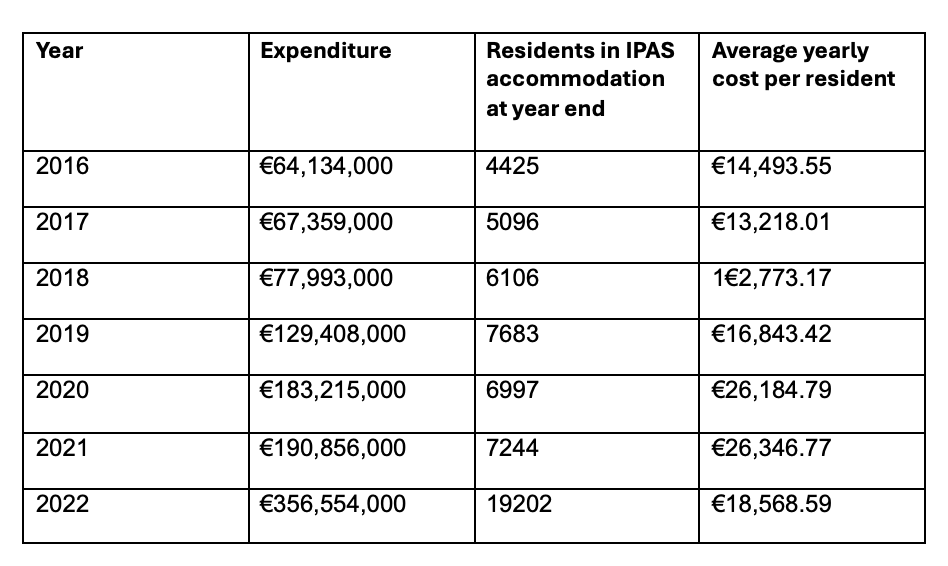

The table above, a response to a PQ from Offaly TD Carol Nolan, shows that the costs of IPAS accommodation had escalated from just over €64 million in 2016 to €356.5 million in 2022, a more than fivefold increase within a seven-year period. The figure for 2023 was over €640 million and will be higher again by the end of 2024, perhaps close to €1 billion.

That reflected the growth in numbers under IPAS supervision from 4,425 in 2016 to 19,202 in 2022, and at present, according to the latest weekly figures, there are 32,656 people in IPAS accommodation.

That is the consequence of the unprecedented and continued growth in numbers since the ending of the Covid restrictions. The upward trend was maintained in 2024 despite the addition of Georgia and other former leading countries of origin to those now (eventually) deemed to be safe.

Over 850 private companies, NGOs and charities, and state agencies are listed as recipients of payments for asylum services in excess of €20,000 for 2023.

Of those, 32 drew down more than €10 million in individual payments. There were just 30 recipients of payments through the Department of Justice who were then the responsible agency for payments in 2016.

Among the early birds were companies such as Aramark/Campbell, Mosney, Bridgestock, Onsite Facilities, Millstreet, and Peachport all of which which have continued to feature over the succeeding years among the major beneficiaries of what it is no exaggeration to describe as a wholly new economic sector.

Not only a wholly new sector but a totally unproductive one, and not just unproductive but also a barrier to real productive investment and to the health of the wider economy and in particular the hospitality sector and its offshoots.

The following are payments for just the first three months of 2024 – though, as we will see, the first on the list has received at least €100 million in total for their part in the asylum industrial complex.

- Cape Wrath €16,762,514

- Travelodge €11,189,310

- Holiday Inn €10,300,687

- Guestford € 9,438,483

- Tifco € 8,397,792

- Total Experience € 7,708,610

- Next Week € 5,852,220

- Mosney Holidays € 5,586,741

- Igo Emergency Management €5,561,713

- Townbe € 3,942,716

The table (above) of top ten recipients for the first quarter of this year includes companies that will be familiar to readers of Gript. They include at number 10 Townbe Unlimited which is at the centre of the ongoing attempt to impose a new accommodation centre on the site of the former Crown Paints site in Coolock.

The leading beneficiary continues to be Cape Wrath/Tetrarch which owns City West and which received another €67 million in 2023 which along with more than €34 million for the first six months of 2024 places their overall take comfortably above €100 million. That’s incredible growth from a modest base of less than €3 million as recently as 2022.

Cape Wrath is nominally under the control of Michael McElligott but owned by Alva Glen Investments which has several shareholders including Tetrarch as well as a company called Hotel Developments with a 26.24% shareholding but which according to the CRO was dissolved in 1982, and Green Hill Technology that has no CRO record.

Cape Wrath made a loss of almost €4 million in 2021 before securing a contract for the use of City West as a Covid quarantine centre. We recently reported how Cape Wrath had a rate bill of €739,680 for 2024 and due to South Dublin County Council paid by the Department of Children, Equality, Disability, Integration and Youth – or, in reality, paid by you, the taxpayer.

City West is supposed to be a guest hotel but it has contributed instead to the ongoing massive diversion of tourist beds which the Irish Tourist Industry Confederation estimated will cost the overall sector €1 billion in 2024. There are numerous examples of how this undermining of the tourist sector has impacted the entire economy.

This has been particularly harmful perhaps in the more tourist dependent and remote rural parts of the country. As we have detailed for example in relation to Vesada Private and it’s taking over of two hotels in Gaoth Dobhair which prefer accommodating refugees to holidaymakers.

In 2022, the biggest single payment for asylum services was of €4.8 million to J Junior Services Unlimited which had connections to the Imperial Hotel in Lisdoonvarna. Similar can be seen in the payments made to Staycity, Maldron, Travelodge, and Seamus ‘Banty’ McEneaney’s Brimwood one of the major earners and which manages a large number of hotels mostly in the northern part of the state. Brimwood trousered almost €36 million in taxpayer cheques in 2023. The McEneaney family is also involved in a number of other companies which draw down payments.

Foreign investors and funds have not been slow to recognise the opportunity presented by this state/taxpayer backed bet to nothing. Tifco which is connected to the giant American equity fund Apollo Global owns Travelodge and took in €30.4 million for those former hotels last year.

The British JMK Group run the Holiday Inn and pocketed €27.4 million. Mosney as can be seen from the table for the first quarter has added another €5.58 million and since then a further €12 million in the following three months to the €26 million from last year and tens of millions for the previous years accommodating asylum seekers rather than providing holiday accommodation.

Next Week owns the Riverside Hotel in Macroom and the Abbeyfield Hotel in Ballaghaderreen. That company is owned by Peppard Investments which has recently moved into a new venture at Mulroy Woods in Donegal and is owned by John Crean and members of the family of Tony O’Neill through two other companies. They have earned millions from the asylum caper.

There are many others of course and most of them do not operate at the same lofty levels as some of those named above. Nor are the overseas connections always obvious or transparent for as we have shown some have gone to great lengths to obscure the details of who ultimately benefits from the vast sums channelled from your pocket to theirs. Not a few are registered overseas in the Isle of Man for example where ownership details are withheld.

Which is another reason among others why all of this needs to be subject to a full public inquiry. There have been similar inquiries and indeed tribunals related to the contracting and payments in other sectors in which the rewards were much less than those we know are in play here.