The National Treasure Management Agency has said that €95 Billion has been paid in interest on the country’s national debt since 2000 – with almost €18 billion paid between 2020 and 2024.

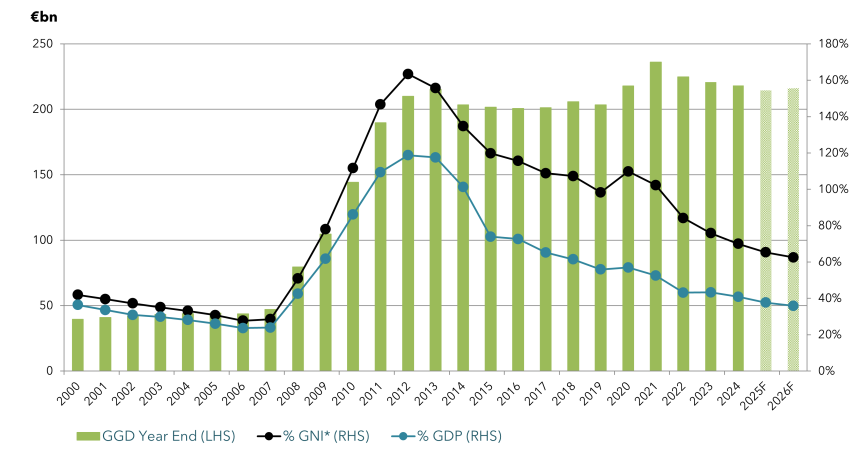

Interest on the debt rarely went above €2 billion in the first ten years of the millennium, but shot up after the financial crash to a high of €7,470 in 2014. In the period from 2000 to 2024, the national debt climbed from €39 billion to €218 billion according to the NTMA – almost a 6-fold increase in borrowings.

In November 2023, the annual cost of servicing Ireland’s national debt equated to about €650 per person living in the country, Department of Finance chief economist John McCarthy, told the Oireachtas Public Accounts Committee (PAC) – adding that, overall, the national debt equates to about €45,000 for every individual in the State a that point.

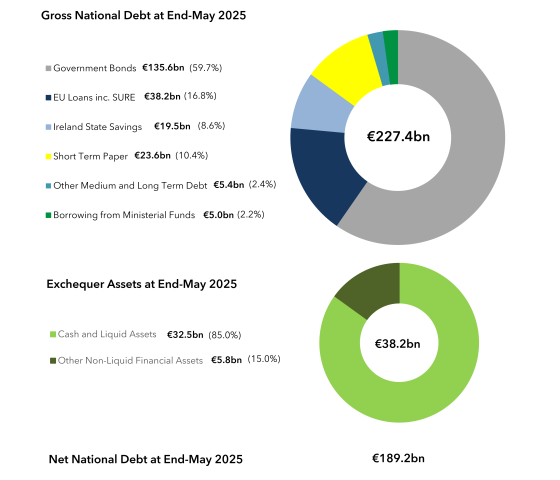

The NTMA says that at end May 2025, Gross National Debt was made up of Government Bonds of €135.6 billion (59.7%) and EU Loans of €38.2 billion (16.8%) – with the remainder being made up of State Savings, Short Term Papers and other debt.

The figures on interest paid was provided by the Minister for Finance in ressponse to a request from Independent TD Carol Nolan who asked for the annual cost of interest payments on the State’s national debt for each year during the period 2000 to date.

| €m | National Debt Interest |

| 2024 | 2,991 |

| 2023 | 3,168 |

| 2022 | 3,701 |

| 2021 | 3,594 |

| 2020 | 4,515 |

| 2019 | 5,048 |

| 2018 | 5,798 |

| 2017 | 6,092 |

| 2016 | 6,741 |

| 2015 | 6,979 |

| 2014 | 7,470 |

| 2013 | 7,324 |

| 2012 | 5,679 |

| 2011 | 4,548 |

| 2010 | 3,492 |

| 2009 | 2,535 |

| 2008 | 1,544 |

| 2007 | 1,619 |

| 2006 | 1,860 |

| 2005 | 1,721 |

| 2004 | 1,677 |

| 2003 | 1,764 |

| 2002 | 1,660 |

| 2001 | 1,875 |

| 2000 | 2,069 |