One of the companies that has continued to do well from the asylum sector is the one which owns the Carnbeg Hotel on the Armagh Road outside Dundalk. It used to be a hotel. Now it is an IPAS accommodation centre.

Since it first received a cheque payable to Carnbeg Hotel and Spa in November 2022 it has banked €22,764,401 – almost €23 million in 26 months, or nearly €1 million per month in state payments.

According to property records, the immediate ownership of the hotel is clear, but the ultimate parent company of the property is registered in the Isle of Man – a common practice in the sector.

Ownership History and Financial Links

The former hotel was already being used as an accommodation centre before 2022 but was contracted out to another major operator which was managing the centre and presumably receiving cheques in its name. The owners of the hotel decided to take over the management of the asylum accommodation themselves.

I did write about Carnbeg last September but it would seem from more recent information that, while the overall picture was accurate, the exact details regarding the different relationships between various entities and the current ownership of the hotel might have been made more apparent.

My search of company records through the CRO had traced ownership of the hotel to a company called Major Ventures and that was listed in its July 2023 return to the CRO as a “wholly owned subsidiary of Tainbo Fund, which is a sub-fund of Shamrock Irish Investment Funds Plc.”

Shamrock Irish Investment Funds had been registered in 2012 as Ballybunion Commercial Property with Patrick O’Sullivan, formerly with Bank of Ireland and Barclay’s Bank, as its sole director. It changed its name to Kylin Investment Funds in 2016.

In 2017, a man named Kai Dai was appointed as a director of Kylin. Regular readers may remember from a piece last September about Carnbeg. Kai has previously run into some bother over his involvement in the Immigrant Investor Programme. Since then the Immigrant Investor Programme scheme was closed by the Irish state, in February 2023, following EU concerns over identity verification and fund origins.

In 2023 the Business Post reported that Kai had been accused of loaning money to investors, despite it being a violation of the terms of the scheme, before later threatening unhappy investors with the loss of their visas.

Kylin changed its name to Shamrock Investment Funds in October 2019 and the notice to the CRO was signed by O’Sullivan. It was declared insolvent and placed into liquidation in July 2023.

Tainbo was wholly owned by Huawen Foundation, which was in liquidation and was registered as owned by Kai Dai. In May 2024, the whereabouts of Kai Dai were reported as “currently unknown.” Huawen was discovered to owe €48.8 million to persons who had subscribed through Huawen in order to avail of the scheme.

I spoke to Ann Lawlor of Lawlor Consultants, who had met with Kai Dai through her own involvement with the Immigrant Investor Programme. She stated that she had ended her contact with him.

Ann Lawlor told me that, as far as she was aware, Ballybunion had been acting as advisors to Shamrock Investment Funds, but she was not certain how or at what stage ownership of Carnbeg Hotel transferred from entities connected to Kai Dai to Ballybunion Capital.

Company records confirm that Shamrock Investment Funds was not an independent entity, but was controlled by Ballybunion.

Ownership of Carnbeg

The ownership of the Carnbeg Hotel is no longer ‘opaque.’ According to the property records, the sole owner of Carnbeg since July 2017 is Major Ventures which is listed as entirely owned by Ballybunion Limited, whose sole directors are Patrick O’Sullivan and Raymond Murphy.

The CRO lists Major Ventures as having become involved with Carnbeg in March 2018. There is no mortgage charge on the property which indicates that it had been bought outright.

There were others interested, it would seem, in acquiring the hotel and golf course even after Major Ventures and Ballybunion had bought the site from previous owners who appear to have run into difficulties.

Gript understands that an offer was made during the Covid period to buy the hotel from Ballybunion, and that the potential buyers made it clear that they would not be interested in acquiring the hotel if it was given over to be used as a direct provision centre.

The company trail here ends with the listing of Major Ventures as the owner of Carnbeg as that company’s sole shareholder, Ballybunion Limited, has no registration with the CRO.

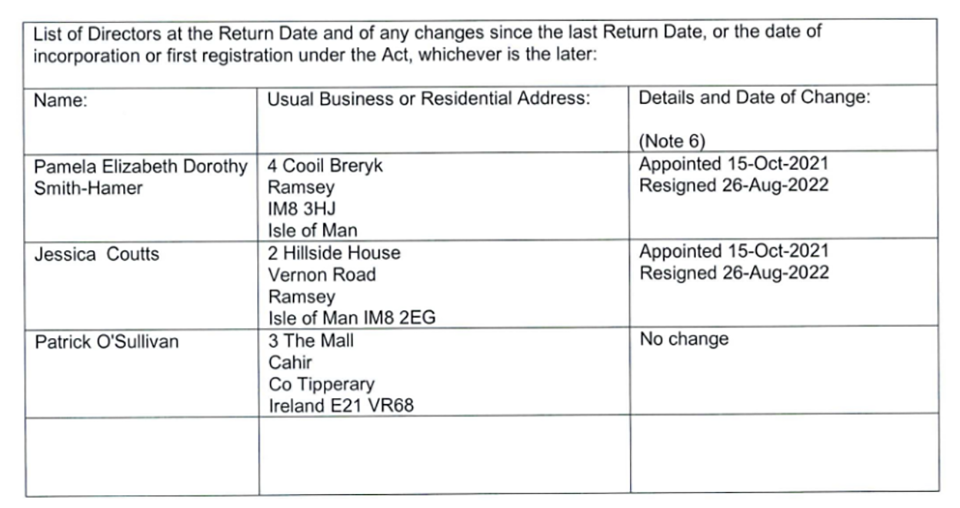

It is registered in the Isle of Man and according to its annual return registered with the Isle of Man companies office on September 9, 2024 the sole director of the company is Patrick O’Sullivan of County Tipperary.

Ballybunion Capital was bought by the giant Jersey based JTC in September 2021. Patrick O’Sullivan, who was the founder of the Ballybunion group, was retained in a “leadership role” and enthused about the “strong cultural alignment” he found in JTC. That company in turn was pleased to be able to wet its beak in “the strategically important Irish AIFM market.”

AIFM for those of us who only contribute as taxpayers to the cheques rather than collect them is Alternative Investment Fund Manager.

The alternative and attraction in this case as well as many other cool sounding projects is using former hotels in particular as asylum accommodation as a much more lucrative alternative to taking in tourists and lads playing golf.

In July 2022, JTC announced that Orla Philippon had been appointed as CEO of Ballybunion Capital Limited (Ballybunion) to replace O’Sullivan. He was “delighted to be handing over the baton to Orla.” Philippon had been with O’Sullivan in Ballybunion since 2018.

Given that JTC now controls Ballybunion, I had assumed that they now owned the Carnbeg Hotel, which is still registered as being owned by Major Ventures which was a wholly owned subsidiary of Ballybunion and therefore presumably part of the assets acquired by JTC.

However, when I contacted Orla Philippon, to ask her if she was aware that the Carnbeg Hotel was being used as an IPAS centre and if JTC intended to continue to use it for that purpose, she responded by stating that “The Carnbeg Hotel is not an asset currently managed by JTC.”

I sought further clarification as to “how JTC which has acquired Ballybunion and its assets could not be the owner of Carnbeg,” or was it the case “that JTC owns Carnbeg but has contracted the management of the hotel to another company?”

In response, Orla Philippon said: “I am going to reiterate what I already said: The Carnbeg Hotel is not an asset currently managed by JTC.”

I also rang Patrick O’Sullivan and asked him who were the current owners of the Carnbeg Hotel. He declined to comment.

It’s worth reminding ourselves that the Carnbeg Hotel has banked €22,764,401 – almost €23 million in 26 months, or nearly €1 million per month, from the taxpayer. The lack of transparency is notable.

Transparency Issues and Beneficial Ownership Laws

Ballybunion Limited, like several other companies involved in asylum accommodation, is registered in the Isle of Man, a jurisdiction where beneficial ownership records are not publicly accessible.

A recent Isle of Man Today article highlighted that, while governments and law enforcement agencies can access beneficial ownership registers,the fact that such records are not publicly available is an issue under review by the UK government due to concerns over corporate transparency.

Ballybunion Limited was registered in the Isle of Man on September 7, 2020 with O’Sullivan as the sole shareholder. Its first annual return, filed in November 2021, was presented by Greystone Trust Company Limited, which later merged with Charterhouse Lombard in October 2023.

A Robert Huyton – who we also mentioned in relation to the Charterhouse interest in the proposed asylum centre on Aston Quay – signed a company document on behalf of Ballybunion in April 2022. O’Sullivan, Hamer-Smith and Jessica Coutts are named as current or recent Ballybunion directors in the annual company return of September 9, 2022.

Attempts by Gript and TDs to obtain further transparency on state payments for asylum accommodation have been refused by the Department of Integration, citing commercial sensitivity. Given the clear public interest in this area, that’s not a situation that should be allowed to continue.