Government spending is increasing at a rapid pace, while failing to produce budgetary forecasts beyond next year, according to the State spending watchdog, the Irish Fiscal Advisory Council (IFAC).

This comes even as the country is set to face “large budgetary pressures” in the coming decades, IFAC warned, adding that supporting an ageing population, climate change-related spending and investment in infrastructure could push public finances from a surplus into “a significant deficit”.

In the scathing report issued by the council, the Government scored just one out of eight points on the “checklist for a better fiscal framework”.

Under the heading, ‘Clear guardrails’, the Government received approval for putting in place appropriate savings funds for excess corporation tax.

However, it received negative assessments according to every other practice, including forecasting and transparency.

In its summary of fiscal performance, IFAC said that the Government was “budgeting like there’s no tomorrow”.

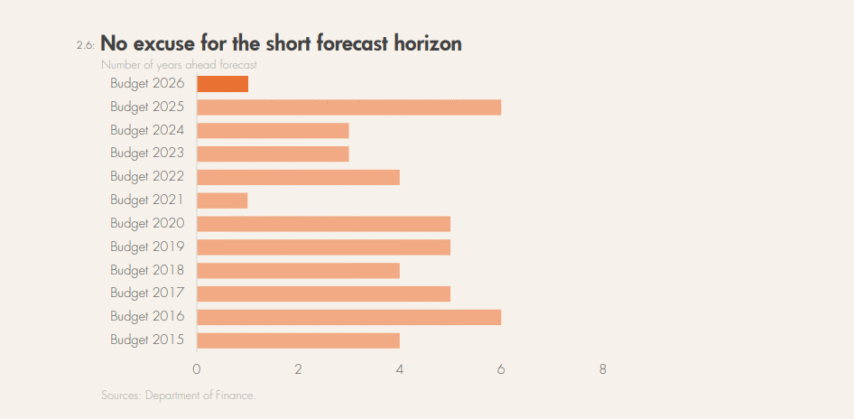

“Budget 2026 contained no budgetary forecasts beyond next year. Good planning and budgeting require forecasts that go more than 15 months ahead,” it said.

IFAC compared Budget 2026’s forecast horizon to that of 2021’s, which was comparable in terms of shortness.

However, the agency noted that Budget 2021 was produced “at the height of the Covid-19 pandemic,” and added that “there is no excuse for the short forecast horizon” currently.

There is “no effective framework for fiscal policy in Ireland,” it said, as the Government has not set “any rule or guide for budgetary policy”.

“Despite commitments in the Programme for Government to submit an updated Medium-Term Plan to the European Commission, this has not happened,” IFAC said.

The State agency advised Government to move away from year-to-year budgeting, saying that moving to multi-annual budgeting would “give government agencies more certainty over their future funding”.

“This would support better planning and delivery of public services, along with the investment needed to sustain growth in Ireland,” it said.

Ireland’s public finances appear solid “at first glance,” the report stated, cautioning that they “depend heavily on volatile corporation tax”.

Corporation tax is the element keeping the public finances in surplus, IFAC said, outlining that while Ireland experienced a €23 million surplus last year, without excess corporation tax, the country would have experienced a €5 million deficit.

For 2025, with excess corporation tax, a €10 billion surplus is recorded, but without it, a deficit of €7 billion. Meanwhile, a surplus for 2026 with excess corporation tax of €5 million is projected, while without excess corporation tax, a deficit of €14 billion would be expected.

“Without these receipts, there would be a significant and growing deficit. This comes at a time when the economy is performing well and generating substantial tax receipts,” IFAC said.

It said that the Government is planning on spending most of its corporation tax receipts, with only

15 percent of corporation tax receipts to be saved next year, significantly down from 32 percent this year.

“This is a marked shift in policy. It means the public finances are less well prepared for the next economic downturn and predictable budgetary pressures.”

The council criticised ongoing overruns, observing that for 2025, spending is projected to exceed the level of €105.4 billion, set in Budget 2025.

“In fact, Budget 2026 is now forecasting that spending in 2025 will be €109.1 billion.

“As the Council pointed out in its December 2024 Fiscal Assessment Report (Irish Fiscal Advisory Council 2024), this was predictable as overruns in 2024 were ignored and not factored into the spending base for 2025.

“The result is spending in 2025 will be €12.5 billion more than the €96.6 billion figure originally set out for 2024,” it said.

The council said that it is hard to discern what 2025’s likely overrun will be, as despite requesting the monthly departmental spending profiles on multiple occasions, the Department of Public Expenditure, Infrastructure, Public Sector Reform and Digitisation had failed to provide them.

“However, based on recent trends, current spending could be as much as €0.7 billion higher than forecast in Budget 2026. These post-budget overruns are a fundamental budgetary failing, which appears to be repeated every year,” it said.

Commenting on the report, IFAC Chairperson Seamus Coffey said that the Irish economy is “performing well,” and “does not require support from budgetary policy”.

“The Government plans to run a smaller surplus next year. That means we are saving an even smaller share of our corporation tax receipts,” he said, adding that “by adding money into the economy when it is strong, the public finances are less well prepared for the next economic downturn and predictable budgetary pressures.”

The Irish Fiscal Advisory Council’s Assessment Report can be found in full here.