A pension fund of the former Chief Operating Office of Anglo Irish Bank, Tiarnan O’Mahoney, is connected to one of the myriad of companies earning vast sums of money from the asylum accommodation sector.

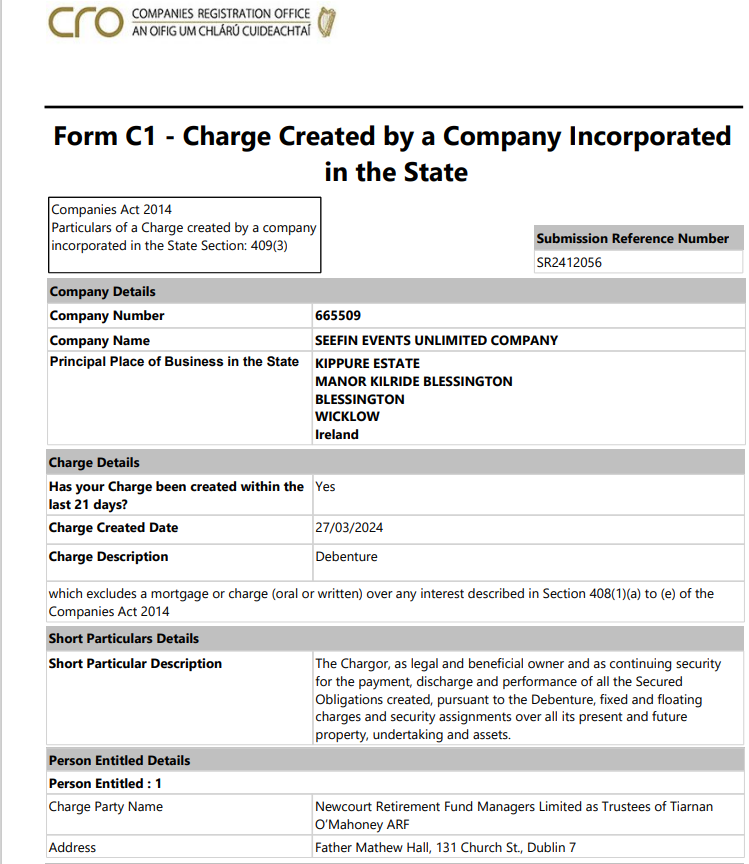

Records held by the Companies Registration Office (CRO) show that on March 27 this year Seefin Events Unlimited registered a charge, effectively a loan, with the Newcourt Retirement Fund Managers as “Trustees of Tiarnan O’Mahoney ARF.” An Approved Retirement Fund is a means of investing your pension savings after retirement, with the advantage that your fund can continue to increase in value and it can be inherited.

O’Mahoney is therefore now one of the beneficiaries of the accommodation payments drawn down by Seefin Events Unlimited which is based at the Goldstein/Quanta owned Kippure Estate which hosts persons claiming asylum.

Seefin is owned by a company called Edgewell which Matt Treacy showed last week is owned by another company, now called Besga, which is registered in the Isle of Man tax haven and whose owners are kept secret. Seefin to the end of March this year has received €14,450,615 in payments from Minister Roderic O’Gorman’s Department.

Bergvon, as the company now called Besga was called prior to changing its name, was a partnership between Biska Unlimited and Jetara Unlimited, both of which have addresses at the building which contains the IPAS accommodation centre at 2 Gateway, East Wall.

Biska Unlimited, according to its 2023 annual return registered with the CRO is wholly owned by the Ballyglen Foundation, another Isle of Man company whose ownership and other details are redacted on the forms seen by Gript.

O’Mahoney had left Anglo prior to its disastrous collapse in December 2009. The Irish state decided to effectively save the “bond holders” and to accept the imposition of an enormous debt upon the citizens of the state.

O’Mahoney was sentenced to three years in July 2015 for conspiring to conceal or alter bank accounts being sought by Revenue, but that conviction was quashed by the Court of Appeal in April 2016.

The state had entered another prosecution, but on November 1, 2017 O’Mahoney was cleared of all charges.

The Currency reported in 2021 that O’Mahoney was attempting to launch a new €200 million alternative capital fund called Helios Capital Markets. Helios was incorporated in April 2021 with O’Mahoney as sole director and shareholder.